Brilliant Info About How To Get A Tax Bonus

A bonus is always a welcome bump in pay, but it’s taxed differently from regular income.

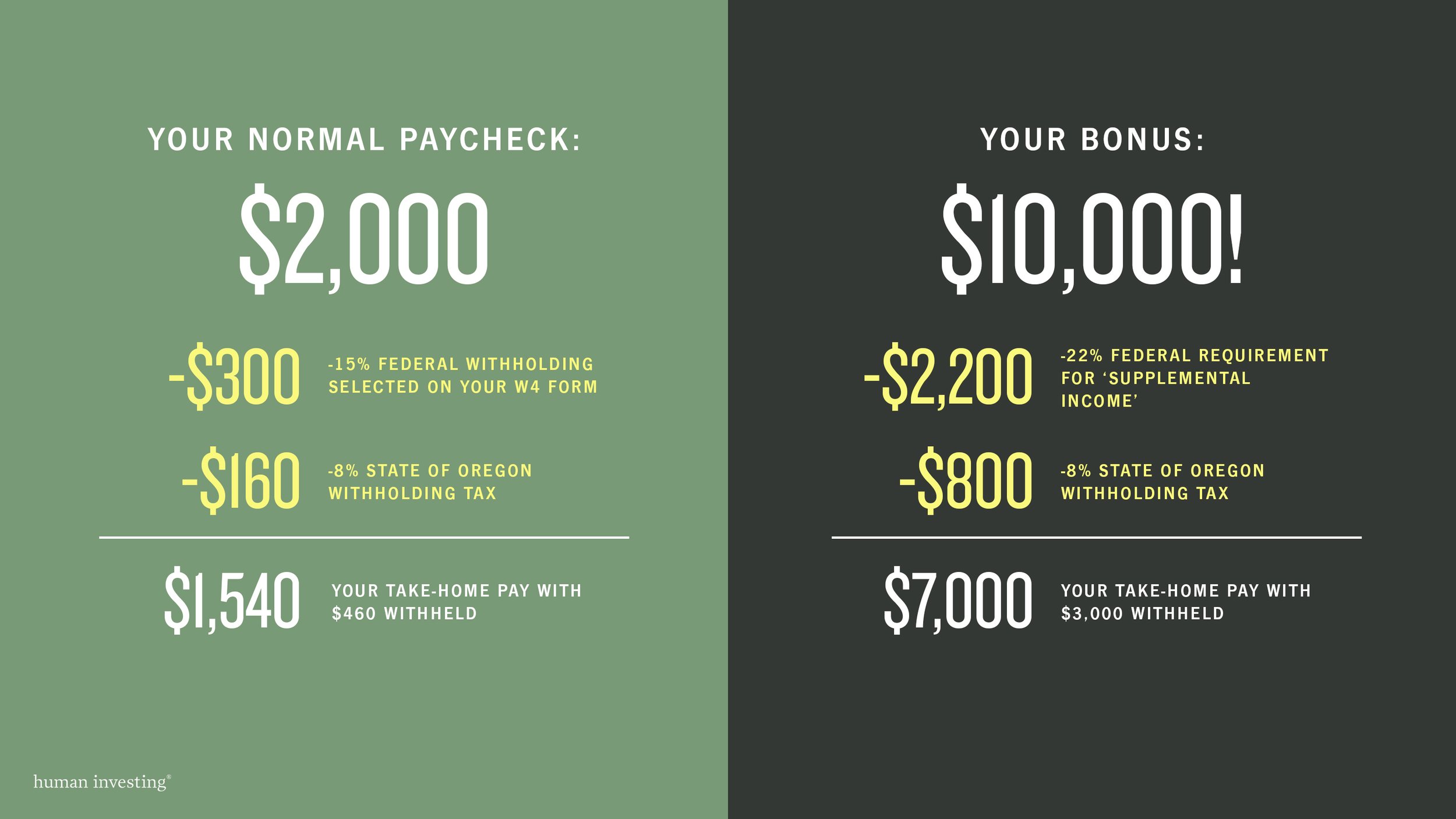

How to get a tax bonus. It’s a good idea to consult a tax pro about your specific situation, but in general, your employer will withhold taxes on your bonus. Over 12 months, that wage puts you in the 22% tax rate ($90,000). Discretionary compensation is supplemental income given by employers as a reward for performance, achievements, or.

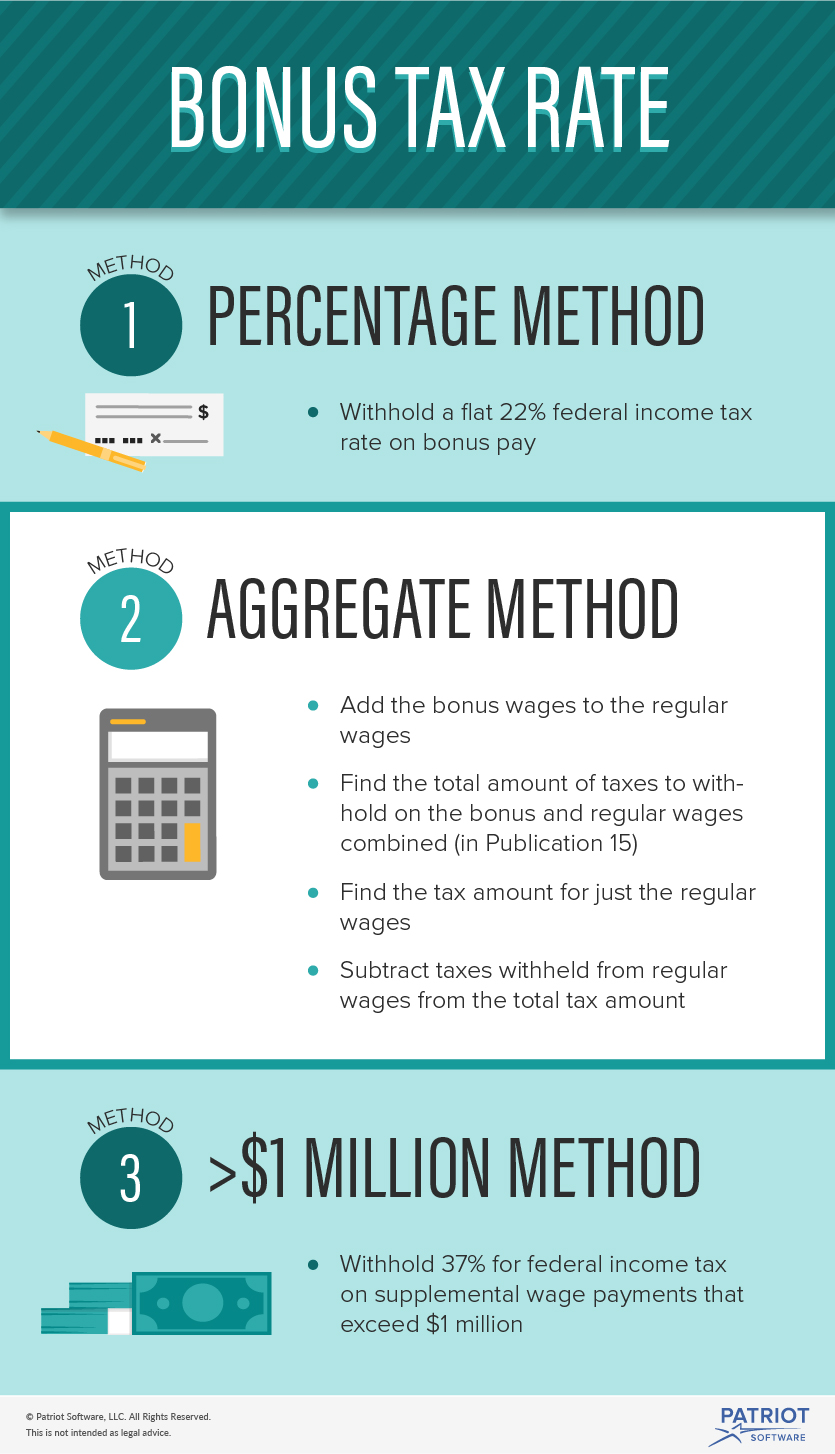

The irs specifies a flat “supplemental rate” of 25%, meaning that any. For earners making between £12,571 to. It requires withholding a flat rate of 22% from the employee’s bonus amount.

If you receive a $3,000 bonus, with the aggregate method, you add that to your regular wage, $3,000 + $7,500. Welcome to the bonus tax calculator, our free. How are bonuses taxed?

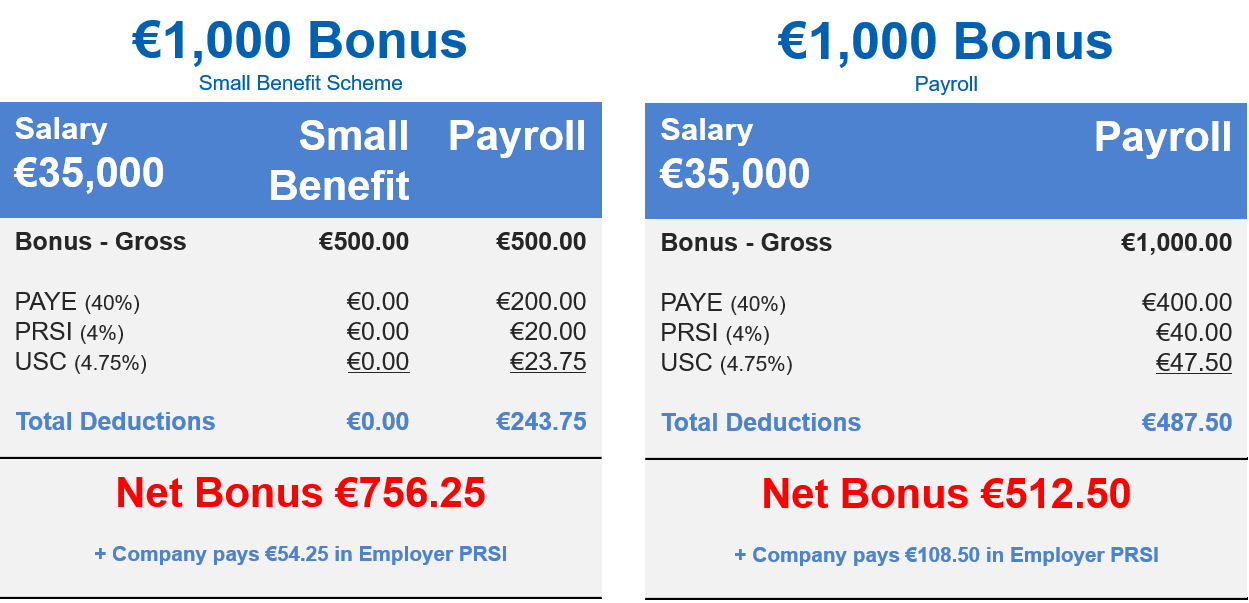

A scheme previously allowed shoppers from abroad to reclaim 20%. Your employer has two options to withhold the appropriate level of tax: How are bonuses taxed?

The tax rate that you will pay on your bonus will depend on the income bracket that you fall into in 2022: Instead of adding it to your ordinary income and taxing it at your top. See the example below to get a better sense of how the way your employer pays taxes on your bonus can change your tax burden.

Everything is neatly organized and easily accessible. This is the method your employer will use if, like i did, you receive your bonus. The way a bonus is taxed depends on your specific circumstances and without more information we can't tell you exactly what the tax should be.

I am leaving that position to retire early and will pay back $60,000 of the bonus. With the pdf editor, you can. They can either withhold 22% of the bonus (the percentage method) to give to the irs, or.

Pay down credit card debt. To make planning easier we have produced this quick tool to allow you to see how much of any bonus you get to keep, and how much is taken off for the treasury. Employers take taxes from your check in one of two ways:

Aggregate method many employers choose the percentage method because it’s easy. Which method gets applied to your bonus? Pick your withholding rate offset the bonus tax with deductions mitigate the bonus tax with contributions ask your employer for workplace perks instead bonus.

The irs considers bonuses as a form of wages, and as such, they're subject to federal taxes, just like your normal pay. You can't deduct contributions from your taxable income.